IRS Says You Underreported Income?

A CP2000 is usually not an audit, not a final bill, and not a sign that the IRS thinks you committed fraud. It’s a computer-generated IRS underreported income notice that flags a mismatch between your tax return and information the IRS received from third parties.

Handled correctly, a CP2000 can often be resolved cleanly. Ignored, it can spiral into penalties, interest, and much more serious enforcement.

A CP2000 notice from the IRS indicates, “Based on the documents we received, something doesn’t line up with what you reported.” It is a proposal outlining what the IRS believes should be adjusted and asking for your agreement.

The IRS runs automated matching programs that compare your return to forms like W-2s, 1099s, brokerage statements, retirement reports, and payment processor data. When the numbers don’t match, a CP2000 is generated.

That’s important because a CP2000 is not:

- A formal audit

- A criminal investigation

- Proof you did anything intentionally wrong

Why CP2000 Notices Are So Common

Most CP2000 cases come from very ordinary situations. Sometimes income was genuinely missed, such as an old brokerage account, a side gig, or a forgotten 1099. Other times, the income was reported, but not in the way the IRS expected.

One of the most common problems is that the IRS sees gross numbers, but not the full story. Stock sales, crypto transactions, and 1099-K activity are frequent triggers because the IRS may see proceeds without cost basis, fees, refunds, or reimbursements. To a computer, that looks like unreported income.

Retirement rollovers are another frequent source of confusion. A rollover that was non-taxable on your return may still appear taxable to the IRS if it wasn’t coded or documented the way their system expects.

In short, CP2000 notices usually result from how information was reported, not because the IRS uncovered hidden information.

The CP2000 Deadline

Every CP2000 notice includes a response date. That date is not a suggestion.

The CP2000 deadline is your opportunity to explain your position before the IRS moves forward without you. If you miss it, the IRS can proceed as though you agreed with their proposal.

Ignoring a CP2000 doesn’t make it go away. If you need extra time to collect records, you can sometimes request it, but you must do so before the response deadline. Staying silent is the worst option, as it often results in:

- A formal bill

- Additional penalties and interest

- A Statutory Notice of Deficiency, which triggers strict legal deadlines and reduces your options

What the IRS Thinks Is Wrong

A CP2000 package usually includes a summary of proposed changes and the documents the IRS relied on. Before responding, you need to understand exactly what the IRS believes happened.

Sometimes the IRS thinks you earned income you never reported. Other times, the IRS believes income was taxable when it wasn’t, or that deductions or offsets weren’t supported.

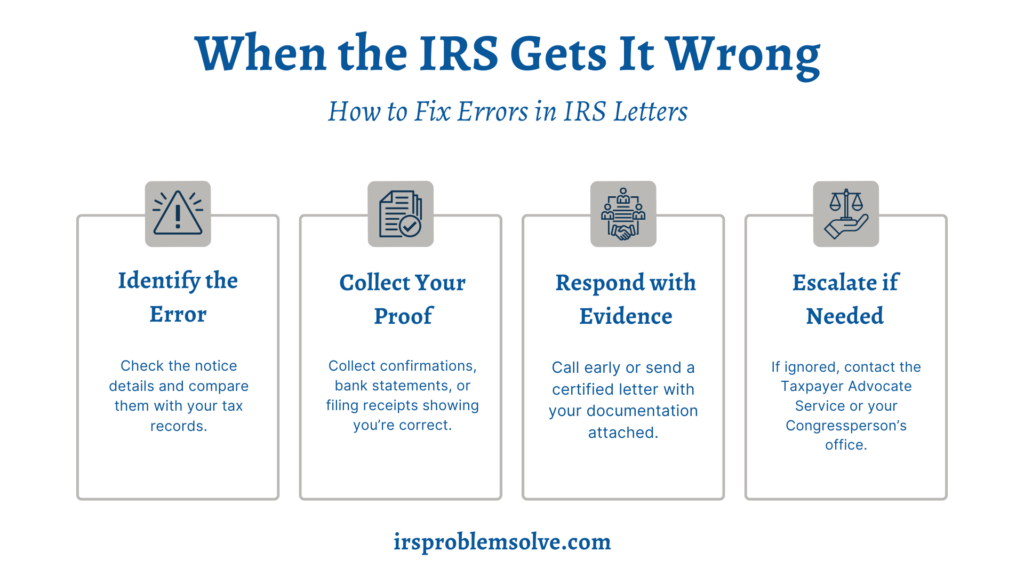

The mistake many taxpayers make is responding emotionally instead of analytically. A strong CP2000 response starts by identifying the specific mismatch, not by arguing broadly that the IRS is “wrong.”

How to Respond Without Making Things Worse

A good CP2000 response is organized, factual, and focused. It doesn’t over-explain, and it doesn’t send the IRS unnecessary information that creates new questions.

The first step is comparing the notice to your filed return line by line. You need to know whether the IRS is flagging missing income, misclassified income, or missing basis or documentation.

Next, gather records that directly support your position. Brokerage statements, Form 8949 details, corrected 1099s, bank records, invoices, or rollover confirmations are far more persuasive than explanations alone.

When responding, you’ll indicate whether you agree, partially agree, or disagree with the proposed changes. Many cases fall into the middle category where the IRS is partially right, but the numbers are wrong.

Your response should clearly explain why the IRS’s calculation is incorrect and include supporting documentation. Originals should never be sent, and every page should clearly identify you and the tax year involved.

Do You Need to Amend Your Return?

Not always, and this is where many taxpayers make mistakes.

If the IRS’s proposed change is correct and there are no other adjustments, a signed response and payment arrangement may be enough. Filing an amended return unnecessarily can delay resolution or introduce new discrepancies.

If correcting the CP2000 issue requires adjusting other items on the return, an amendment may be appropriate. Still, it should be coordinated carefully as part of the response strategy.

This is one area where professional guidance often saves time and prevents escalation.

Penalties, Interest, and Timing

A CP2000 often includes proposed interest and, in some cases, penalties. Interest continues to accrue until the matter is resolved, which is why delays can be costly even if you ultimately prevail.

Accuracy-related penalties are sometimes proposed when the IRS believes there was negligence or a substantial understatement. These penalties are not automatic, and they can often be challenged when the facts support reasonable cause or good-faith reporting.

The faster you respond and the cleaner your documentation, the more control you have over the outcome.

Real-World CP2000 Scenarios

Many CP2000 cases follow predictable patterns.

The IRS may believe you made far more on stock or crypto sales than you actually did because it doesn’t see your cost basis. Or it may treat all 1099-K deposits as taxable income, ignoring refunds, fees, or pass-through amounts.

In retirement cases, the IRS may treat a rollover as fully taxable when it wasn’t. In each of these situations, the IRS isn’t accusing you of wrongdoing.

A strong response clearly and efficiently provides that context.

When It Makes Sense to Get Help

A CP2000 notice is serious but manageable. It’s the IRS asking a question, not issuing a verdict. Some CP2000 notices are relatively simple.

However, if the dollar amounts are significant, multiple income streams are involved, business or crypto activity is at issue, or penalties are being asserted, professional review can make a meaningful difference.

Our office regularly reviews CP2000 packages and drafts complete written responses designed to correct the IRS’s assumptions, document your position, and resolve the matter before it escalates.

Meet the deadline. Respond with documentation, not frustration. And remember that how you handle a CP2000 often determines whether the issue ends quietly. If you’re unsure how to proceed, getting help early is often the most cost-effective decision you can make. I’m happy to help. Send me a message to get started!