IRS Offer in Compromise Guide

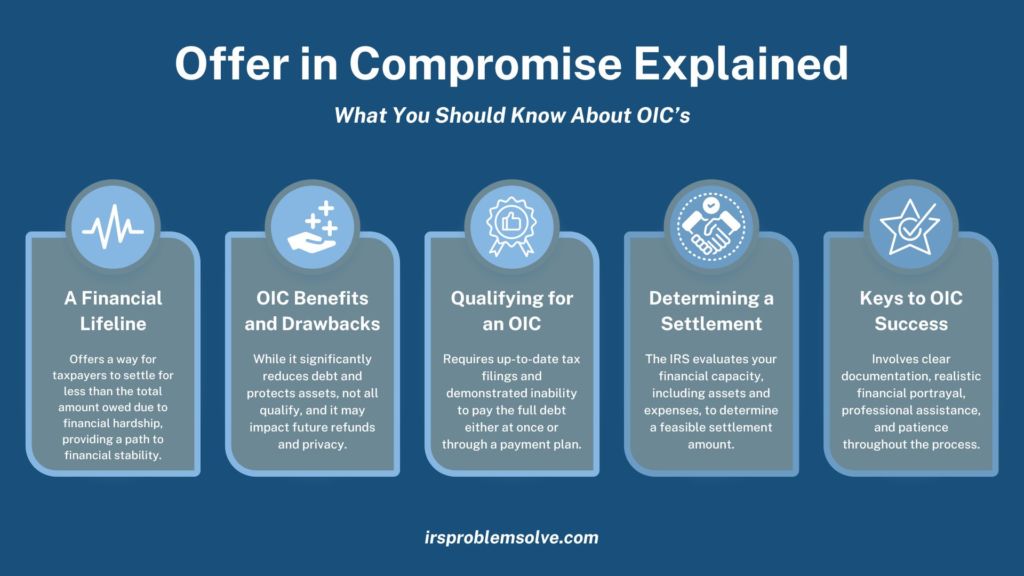

Welcome to our guide on IRS Offer in Compromise (OIC), a potentially life-changing solution for those drowning in tax debt. An OIC allows taxpayers to settle their outstanding liabilities with the IRS for less than the full amount owed.

This program is designed for individuals who cannot fully pay their tax debts due to financial hardship, offering a fresh start and a path toward financial stability. Find out if it’s right for you!

What Are the Pros and Cons of Offer in Compromise?

Pros:

- Debt Reduction: One of the most compelling benefits of an OIC is the possibility of significantly reducing the total amount owed to the IRS.

- Asset Protection: Successfully negotiating an OIC can prevent the IRS from seizing your assets or garnishing your wages, offering peace of mind.

- Final Resolution: An OIC provides a conclusive solution for those burdened by longstanding tax debt, allowing you to move forward without the weight of unresolved tax liabilities.

Cons:

- Eligibility Criteria: Not everyone qualifies for an OIC specifically aimed at individuals who truly cannot afford to pay their tax debt in full.

- Potential for Lower Refunds: Opting for an OIC might mean forfeiting certain tax credits, which could reduce future tax refunds.

- Public Record: Entering into an OIC agreement becomes a matter of public record, which might concern some about privacy.

Eligibility Criteria for an Offer in Compromise

To qualify for an OIC, you must meet specific IRS criteria. These include filing all required tax returns, making all required estimated tax payments, and not being in an open bankruptcy proceeding.

The IRS also requires that you demonstrate an inability to pay the full tax debt as a lump sum or through a payment arrangement.

How Much Will the IRS Usually Settle For?

How Much Will the IRS Usually Settle For?

The amount the IRS will agree to settle for varies significantly from case to case. The agency uses a formula to determine what you can realistically pay, considering your assets, income, monthly expenses, and savings.

While there’s no standard percentage, the aim is to reach an agreement reflecting your maximum pay ability.

What is the Acceptance Rate for IRS Offer in Compromise?

The current acceptance rate for OICs is 36.55%, indicating that slightly over one-third of submissions are approved. Success largely depends on the type of OIC filed, the proposed offer amount, and the thoroughness of the financial hardship demonstration.

The higher acceptance rate for Doubt as to Collectability (DATC) cases suggests that proving your inability to pay the full amount enhances your chances of approval.

Tips for a Successful Offer in Compromise Application

To increase your chances of OIC acceptance, consider these strategies:

- Engage with a Tax Professional: Expertise in tax law and IRS procedures can significantly improve your application’s quality and likelihood of acceptance.

- Be Honest and Thorough: Accurately represent your financial situation. Underestimating your assets or income can lead to rejection.

- Complete and Clear Documentation: Your submission should be comprehensive and understandable, including all required information and supporting documents.

- Exercise Patience. The OIC process is lengthy. Stay informed and communicate openly with the IRS throughout the review period.

How Long Does an IRS Offer in Compromise Take?

How Long Does an IRS Offer in Compromise Take?

The timeline for an IRS Offer in Compromise (OIC) can vary significantly, potentially extending up to 24 months. This includes the initial review of your Form 656 and supporting documents, the IRS’s comprehensive investigation into your financial situation, and the time needed for any appeals or negotiations. It’s a detailed process, but understanding that patience is key can help set realistic expectations for those seeking tax relief through an OIC.

When to Consider Other Tax Debt Relief Options

An OIC might not be suitable for everyone. If you find you don’t qualify or your application is rejected, there are alternatives:

- Installment Agreements: Allows you to pay your tax debt over time in manageable amounts.

- Currently Not Collectible Status: If you can prove severe financial hardship, the IRS may temporarily halt collection efforts.

- Innocent Spouse Relief: Provides relief if your spouse or former spouse failed to report income, reported income improperly, or claimed improper deductions or credits.

Does an IRS Compromise Hurt Your Credit?

While the OIC doesn’t directly impact your credit score, the actions leading up to it might. For instance, tax liens, which the IRS might file as part of the debt collection process, appear on your credit report and can negatively affect your score. However, completing an OIC and releasing the lien can be a positive step toward financial recovery, potentially improving your credit over time.

Steps to Apply for an Offer in Compromise

Steps to Apply for an Offer in Compromise

Applying for an OIC involves careful preparation and documentation:

- Assess Eligibility: Use the OIC Pre-Qualifier Tool to gauge your qualifications.

- Complete Necessary Forms: Fill out IRS Form 656 and Form 433-A (for individuals) or 433-B (for businesses), detailing your financial situation.

- Submit Application and Initial Payment: Include an initial payment (20% of your offer for a lump-sum payment option) along with the $205 application fee.

- Choose Your Payment Option: You can choose between a lump-sum payment (requiring 20% upfront) or periodic payments over 24 months.

Exploring these options can offer pathways to resolving your tax liabilities without an OIC. As part of our commitment to providing comprehensive tax relief assistance, Todd S. Unger, Esq., is here to help evaluate these alternatives and guide you toward the best solution for your unique situation.

Need legal help? Give Todd a call for professional guidance! (877) 544-4743