IRS Letters with Errors: Your Step-by-Step Fix

Few things cause anxiety like opening an IRS letter, especially one that insists you owe money you don’t, or that you failed to file a return you know you sent months ago. Maybe the letter even claims your estimated payments never arrived. And when you try to call the number on the notice, you can’t get through. The hold music plays endlessly, or the call drops just as you reach a live person.

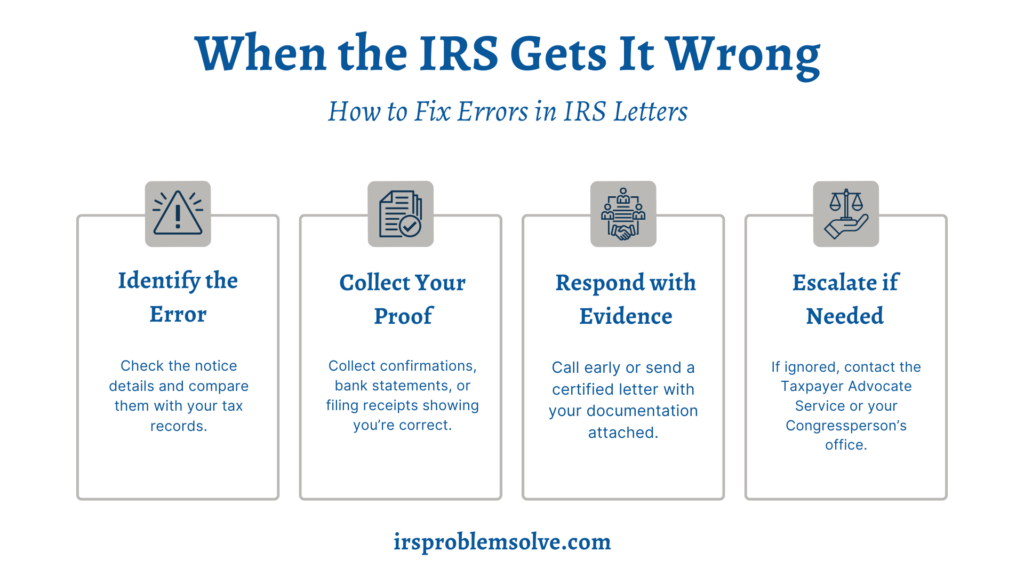

IRS notices can include mistakes like misapplied payments, unprocessed returns, or system delays. Stay calm, gather proof, and correct the record systematically.

Reading Between the Lines

Before you do anything, read the notice carefully. Each IRS letter tells a story if you know how to decode it. Start by noting the notice number, which usually appears in the top right corner. That number reveals why the IRS contacted you.

For example, a CP14 letter states you owe money. A CP23 or CP24 shows that your estimated payments do not align with their records. A CP59 indicates the IRS thinks you did not file a tax return. Sometimes, these notices are generated automatically when information is missing or delayed in the system.

Review all dollar amounts, dates, and tax years, then compare to your records. Did you already pay that balance? Do you have confirmation that your return was filed? Identifying the issue, like a missing payment, misplaced credit, or delayed filing, helps you respond effectively.

Gather Your Proof Before You Respond

If the IRS claims you didn’t file, find your e-file acceptance or certified mail receipt. If they say a payment is missing, locate your bank statement, canceled check, or payment confirmation from IRS Direct Pay or EFTPS.

Keep a copy of the notice itself, too. Circle the relevant amounts or dates and make notes in the margin. These details will help you explain the problem clearly if you reach an IRS representative or if you have to send your explanation by mail later.

It’s also wise to print your IRS account transcript from IRS.gov. This will show what the IRS has on file for you so far and sometimes reveals if a payment was applied to the wrong tax year or spouse’s Social Security number.

Try to Call, but Call Smart

Calling the IRS tests patience, but a well-timed call can resolve issues. The best time is early morning at 7 a.m. local time. Avoid Mondays, lunch, and the week after major filing deadlines to prevent lengthy hold times over an hour.

Have the notice in front of you when you call, and gather every detail you might need: your Social Security number or EIN, the tax year in question, payment dates, check numbers, and confirmation codes. When you reach an agent, calmly explain the issue.

For example: “I received a CP23 notice dated May 15, 2025, showing a missing estimated payment. I made that payment on April 15 via Direct Pay, confirmation number 12345. Can you check if it was applied to the wrong year?”

Make sure to write down all the details the agent shares with you, like their name, ID number, the date, and any case reference they give. If they acknowledge the mistake and assure you a correction, gently ask about how long it will take and if you’ll get it in writing. This way, everything’s clear and you have a record of what was said.

If you can’t get through after several attempts or the hold times are unbearable, it’s time to put your dispute in writing.

Send It the Right Way

A well-written letter can accomplish what a dozen phone calls can’t. Address it to the contact address listed on your notice and clearly reference the notice number, tax year, and your identifying information. Explain the problem in plain, factual language.

For instance, you might write: “I am responding to Notice CP14 dated June 5, 2025. The notice shows a balance due of $2,000. However, I paid this amount via IRS Direct Pay on April 15, 2025 (confirmation attached). Please update your records and remove any related penalties or interest.”

Attach copies of your proof, like payment confirmations or bank statements. Include the notice itself and highlight important figures for clarity. Send your letter via certified mail with a return receipt. Keep a full copy of your submission. The IRS may take weeks or months to respond, but your objection is logged. If you get another letter about the same issue while waiting, call again and mention the mailing date.

When the IRS Stays Silent

Sometimes, even after doing everything right, you hit a wall. That’s when the Taxpayer Advocate Service (TAS) becomes your best ally.

TAS is an independent arm within the IRS that helps when normal channels break down. They can stop collections, locate missing payments, or push stalled cases forward. You can call them directly at 1-877-777-4778 or submit Form 911, Request for Taxpayer Advocate Service Assistance.

If you’re facing financial hardship or unreturned correspondence, TAS can assign a personal advocate to handle your case. They aren’t miracle workers, but can access internal departments that taxpayers can’t reach.

Another overlooked option is contacting your U.S. Representative or Senator’s constituent services office. Each congressional office has staff who handle IRS problems for residents. You’ll fill out a privacy release form authorizing them to discuss your case. They can’t erase your tax debt or rewrite the law, but they can make the IRS respond when it otherwise wouldn’t.

Keep Calm, Stay Documented, and Don’t Ignore It

Always respond before the IRS deadline, even if you believe the IRS is mistaken. If more time is needed to collect documents, contact the relevant parties to inform them. Stay organized by keeping a straightforward folder with notices, correspondence, receipts, and call notes. This folder becomes extremely valuable if you later consult a tax attorney or CPA.

The IRS’s systems are extensive and not flawless. Errors aren’t necessarily your fault. What’s important is how you react quickly, courteously, and with supporting documentation. Although you might not reach the IRS by phone today, maintaining a clear paper trail and a composed attitude can help ensure they handle your case correctly in the future.

Need professional guidance? Reach out to Todd Unger for legal advice.