Wage Garnishment in NJ

Wage garnishment is one of the most direct and forceful methods creditors employ to claim debts owed by individuals. In the state of New Jersey, the repercussions of wage garnishment extend far beyond a mere deduction from one’s paycheck; they can disrupt an individual’s financial equilibrium, potentially rendering them incapable of covering essential living expenses.

Unlike voluntary wage assignments, which are agreed upon between debtor and creditor, wage garnishment is an involuntary process that either follows a court order or, in certain cases like child support and federal student loans, doesn’t require one.

Eligible Debts for Wage Garnishment

Eligible debts that can lead to wage garnishment are broad, with obligations ranging from unpaid child support and federal student loans to back taxes and various consumer debts such as credit card bills and medical expenses. Each category of debt adheres to its own set of rules governing the garnishment process.

For example, garnishments for child support can claim up to 50% of the debtor’s disposable earnings if they are supporting another child or spouse and up to 60% if not, showcasing the stringent nature of certain garnishment regulations.

New Jersey’s Wage Garnishment Laws and Limits

In New Jersey, wage garnishment laws are created to ensure a fair balance between creditors’ rights to collect debts and the financial well-being of debtors. These regulations allow creditors to recover owed amounts while ensuring debtors maintain sufficient income for their essential needs.

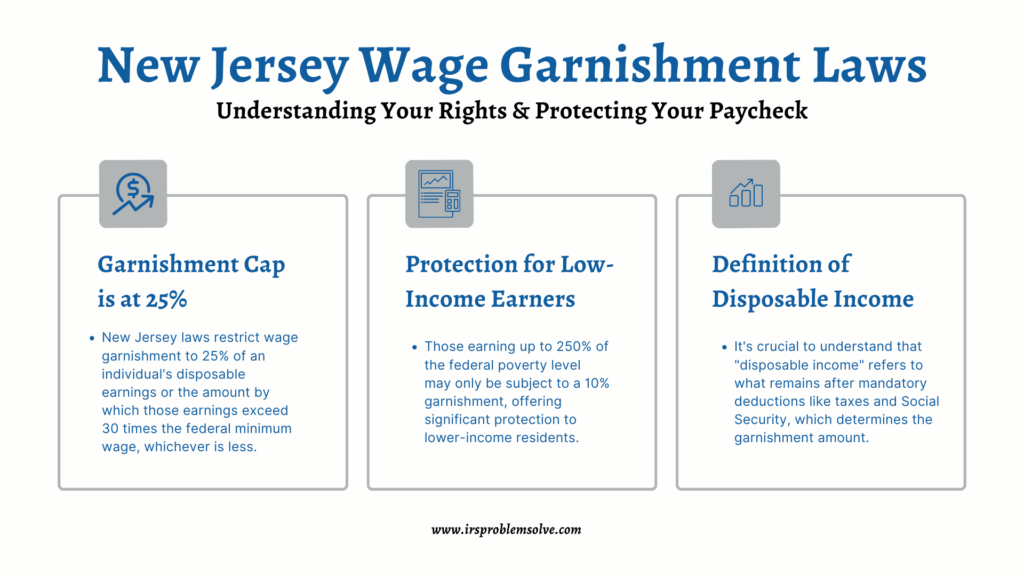

Here’s a quick overview of the key aspects of New Jersey’s wage garnishment limitations:

- Maximum Garnishment Limit: Up to 25% of an individual’s disposable earnings can be garnished unless those earnings are less than 30 times the federal minimum wage.

- Protection for Low-Income Earners: For individuals earning up to 250% of the federal poverty level, garnishment is capped at 10% of their income.

- Disposable Earnings Definition: “Disposable earnings” are the amount left after mandatory deductions, such as taxes and Social Security, are taken from one’s paycheck.

How To Respond to Wage Garnishment Notices

How To Respond to Wage Garnishment Notices

Facing wage garnishment necessitates a strategic and informed response. Verifying the legitimacy of the debt and the corresponding court order is a critical first step. Engagement in the legal process, including attending all relevant hearings, is essential for potentially mitigating the impacts of garnishment.

Ignoring legal notices or failing to participate in court proceedings can severely limit one’s options and lead to less favorable outcomes.

Proactive Measures Against Wage Garnishment

Bankruptcy emerges as a powerful tool to combat wage garnishment, introducing an automatic stay that halts most debt collection efforts, including garnishment.

This legal respite allows debtors to reorganize or discharge their debts under court supervision, offering a pathway to financial rehabilitation.

For those seeking alternatives to bankruptcy, requesting a modification of the garnishment order by demonstrating undue financial hardship may provide relief, enabling a more manageable repayment strategy.

Long-Term Impacts

Wage garnishment impacts the debtor’s current financial situation and can have long-term consequences on their credit score and future borrowing capabilities. When a garnishment occurs, the debtor’s credit report may reflect the judgment, signaling to prospective lenders and creditors that the debtor has previously failed to pay debts as agreed.

This can lead to higher interest rates on loans, difficulty in obtaining mortgages or car loans, and increased scrutiny during credit evaluations.

Moreover, the psychological stress associated with wage garnishment can not be understated, as individuals may face increased anxiety and stress over their financial security and prospects.

How Attorneys Can Help

How Attorneys Can Help

The complexities of wage garnishment in New Jersey require expert guidance and representation, making Todd Unger’s specialized knowledge in tax law and debt resolution an essential asset. His deep understanding of federal and state garnishment laws equips him to provide targeted assistance to those facing garnishment.

Here’s how Todd Unger can make a significant difference:

- Todd Unger offers nuanced legal advice tailored to the specific details of each client’s case, ensuring personalized and effective counsel.

- He negotiates effectively with creditors, striving for settlements that prevent or minimize wage garnishment, thus protecting clients’ financial interests.

- Unger provides robust representation in court, utilizing his expertise to advocate for clients’ rights and work towards favorable outcomes.

- His adept handling of garnishment cases guides clients through the complexities of the legal process from start to finish, safeguarding their rights at every turn.

Talk To Todd

The challenge of wage garnishment, with its potential to destabilize one’s financial life, underscores the importance of knowledgeable legal guidance with the expert counsel of Todd Unger, those facing wage garnishment in New Jersey can navigate their circumstances with confidence, leveraging legal strategies to mitigate the impact on their financial well-being and striving for a future free of overwhelming debt.

Call now for a consultation! (877) 544-4743