Trying To Sell Your Business With Debt? Selling or closing a business is already a major change; IRS debt raises…

Todd Unger

Disagree With the IRS? The IRS appeals process is not one single form or one simple request. It is a…

Tax Resolution Plan for Your Business When business tax problems come up, they often don’t come in a neat package….

IRS Levy on Your Customers? Most people assume the IRS only takes money directly from taxpayers, such as through bank…

What Is Form 433? When you owe the IRS and reach out for relief, it often feels like you’re finally…

IRS Says You Underreported Income? A CP2000 is usually not an audit, not a final bill, and not a sign…

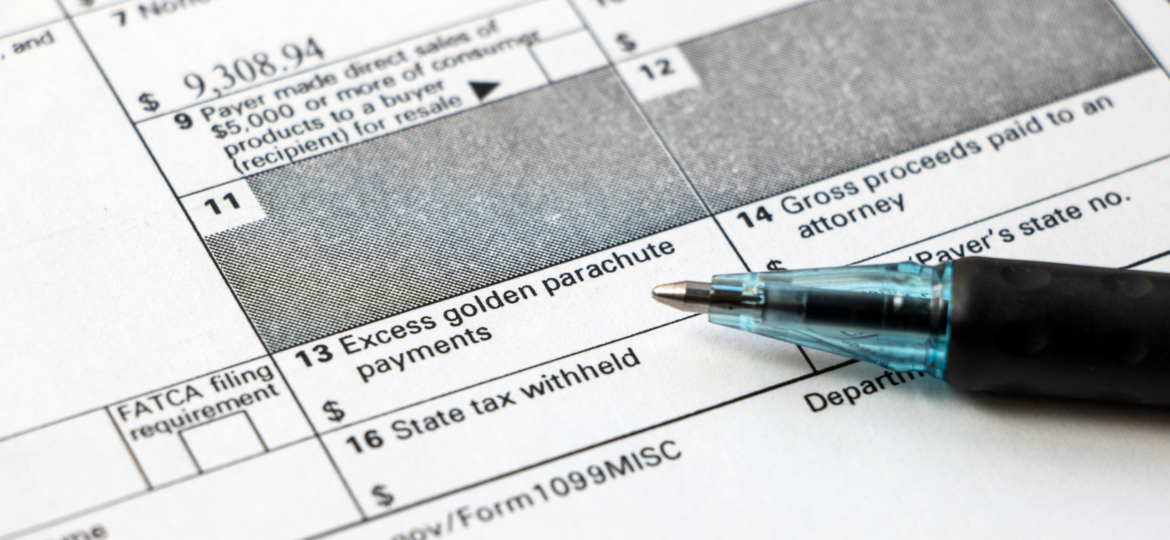

Confused About 1099-NEC Reporting? Contractors are part of everyday life for small and mid-sized businesses, from construction companies and manufacturers…

How To Get Penalties Waived? For many S-corp and partnership owners, the first time they learn about per-partner and per-shareholder…

What Happens If You Ignore an IRS Notice? When the IRS sends a notice, it’s tempting to set it aside…

How Founders and Investors Fix Offshore Tax Issues Going global is exciting until the tax reporting follows you home. Many…