Expert IRS Tax Assistance

We specialize in resolving complex tax issues for individuals and businesses, offering expert legal guidance with a personalized approach. With years of experience in tax law, we understand that tax problems can be stressful and financially overwhelming. That’s why we work diligently to protect our clients’ rights, minimize liabilities, and find practical solutions that provide lasting relief.

Our firm handles various tax matters, including IRS audits, tax debt settlements, payroll tax disputes, penalty abatements, and lien removals. Whether you’re a business owner facing payroll tax issues or an individual struggling with back taxes, we provide strategic, results-driven representation. We believe in clear communication, strong advocacy, and compassionate client service, ensuring every case is handled with the attention and professionalism it deserves.

Todd Unger is committed to helping our clients regain financial stability and peace of mind. If you need assistance with an IRS or state tax issue, we’re here to guide you through the process and fight for the best possible outcome. Let us help you take control of your tax challenges and confidently move forward.

Popular Places We Work:

- New Jersey: Cherry Hill, Edison, Freehold, Mount Laurel, Princeton, Hamilton, Haddonfield, Newark, Toms River, Trenton, Woodbridge, Jersey City, Paterson, Elizabeth, Woodbridge Township, and Lakewood Township

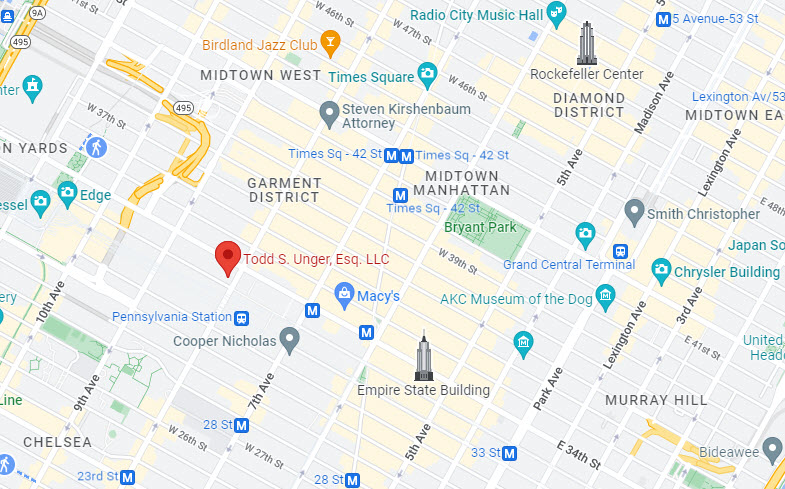

- New York: Midtown East, Upper East Side, Yorkville, Garment District, Chelsea, Lower Manhattan.

Contact Us

Take the first step toward resolving your IRS challenges with confidence. Contact Todd S. Unger, Esq., LLC today to schedule a consultation. Whether in New Jersey, New York, Pennsylvania, or anywhere across the U.S., our team is ready to provide the expert guidance you need. Let us help you take control of your tax issues and achieve peace of mind.

Our Office Locations

Todd S. Unger, Esq., LLC

33 Wood Avenue South, Suite 645

Iselin, NJ 08830

Ph: (877) 544-4743

F: (877) 441-9825

Todd S. Unger, Esq., LLC

5 Penn Plaza, 19th Floor

New York, NY 10001

Ph: (877) 544-4743

F: (877) 441-9825